Economics and markets

The U.S. dollar is unlikely to continue defying gravity

January 09, 2024

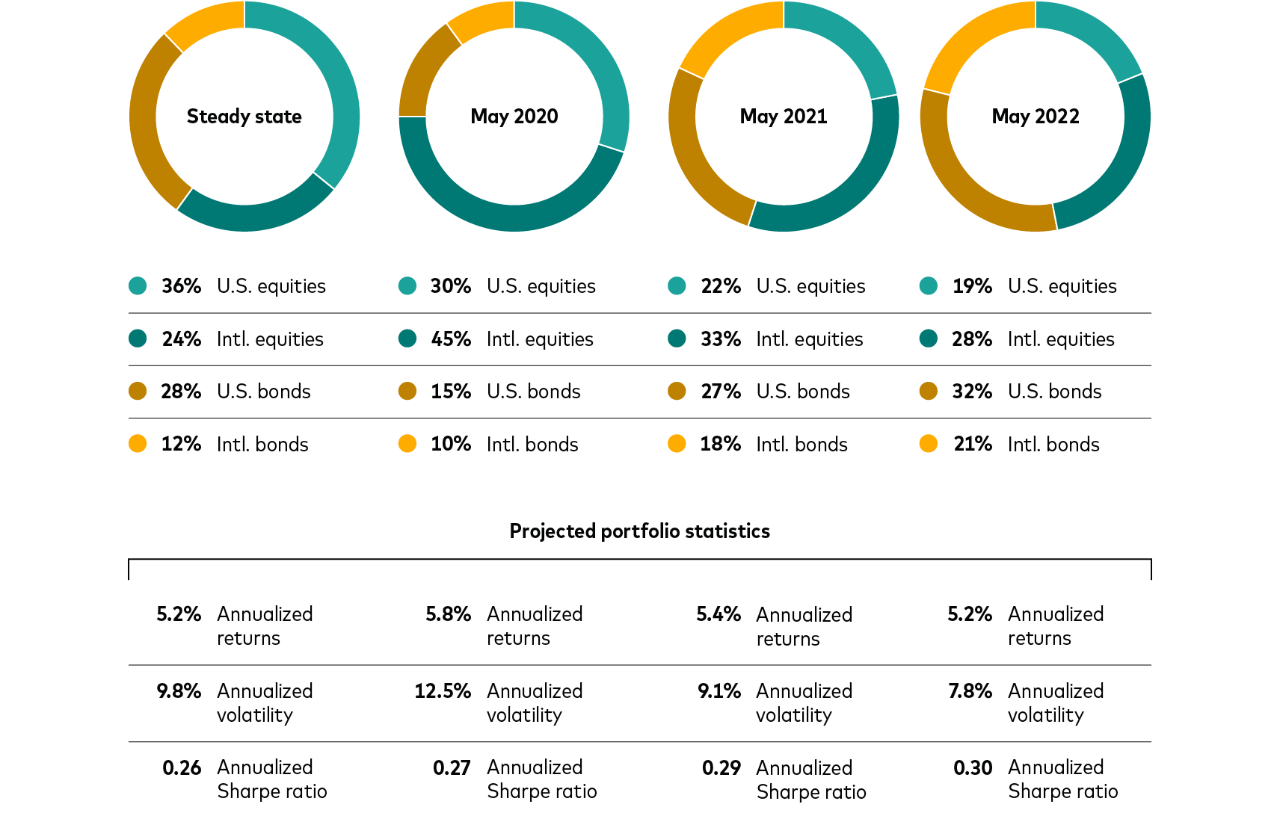

A new, proprietary Vanguard model estimates that the U.S. dollar is roughly 12% overvalued against a basket of five leading currencies heading into 2024. In the coming decade, we estimate the probability of some dollar depreciation at about 75%, with a modest decline of 1.1% annualized the most likely outcome.*

If our outlook is correct, foreign exchange should add 1.1 percentage points annualized to the returns that U.S. investors derive from dividends, corporate profits, and valuation changes of international equity investments. Such a boost assumes a broadly diversified portfolio that is invested initially in U.S. dollars and not hedged against currency risk.

Our expectation of an easing in the dollar’s value is one reason we believe dollar-based investors will earn higher returns on non-U.S. equities than U.S. equities in the decade ending September 30, 2033.** For detailed projections by asset class, see our Vanguard Capital Markets Model® forecasts.

Conditional mean reversion likely to drive U.S. dollar depreciation

“The exceptional run-up in the value of the U.S. dollar was partially justified by attractive valuations 10 years ago and stronger fundamental U.S. economic conditions over the last decade,” said Ian Kresnak, an analyst in our Investment Strategy Group and the lead creator of our exchange rate model. “However, we think the dollar has gone too far and that a correction to our fair-value estimate will drive dollar depreciation in the decade ahead.”

Economic fundamentals will continue to anchor long-term exchange rates

Notes: Our U.S. dollar index and fair-value estimates are proprietary measures that compare the U.S. dollar with an equity market-capitalization-weighted basket of the euro, the Japanese yen, the British pound, the Canadian dollar, and the Australian dollar. The non-U.S. dollar currencies’ index weights reflect the relative weights of MSCI World Index constituent regions and countries that typically trade goods, services, and securities in those currencies. The fair-value estimates are based on the portion of exchange rate movements that can be explained through differentials in relative economic strength, measured by productivity (GDP per capita at purchasing power parity), interest rates, and inflation.

Source: Vanguard calculations, based on data from Refinitiv and the International Monetary Fund, as of September 30, 2023.

Past performance is no guarantee of future returns. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly is in an index.

“Currencies can deviate from their fair values for brief or even extended periods due to factors both rational and irrational,” Kresnak said. “In the long run, however, fundamental economic conditions do a good job of explaining currency values. We expect that will continue to be true, which implies some depreciation and a return to fair value for the dollar based on our outlook for those fundamentals over our 10-year forecast horizon.”

The fundamentals that drive the U.S. dollar’s value

Kresnak and Lukas Brandl-Cheng, an analyst in our Investment Strategy Group and co-creator of our exchange rate model, identified four cross-border variables that drive the value of the dollar. (See adjacent bar chart.) The first two are particularly important over longer periods:

1. Productivity differences. A larger increase in the value of goods and services produced per capita in the United States compared with many competing countries was a key driver of the dollar’s appreciation in the last decade. We expect the U.S. to maintain its productivity edge, given higher public and private investment and technological innovation, but see a less compelling case that relative U.S. productivity gains will match those of the last decade, easing pressure for the dollar to rise further.***

2. Long-term real (inflation-adjusted) interest rate differences. Higher 10-year rates imply higher expected returns and attract capital from yield-seeking investors. In the last decade, real rates tended to move higher in the U.S. relative to other regions, adding to the dollar’s strength. We expect that trend to persist, albeit at a slower pace.

Drivers of the U.S. dollar:

We expect depreciation despite, not because of, continued relative U.S. economic strength

Notes: A proprietary Vanguard index suggests the U.S. dollar was undervalued in 2013. We estimate that about 28% of the dollar’s 3.1% average annual rise during the decade that ended September 30, 2023, owed to faster productivity and interest rate growth in the U.S. compared with most other countries. Conditional mean reversion—the market’s tendency to eventually correct under- and overvaluations relative to fundamentals—explains about one-third (32%) of the increase. The remaining 40% rise does not appear justified by fundamental economic conditions, leaving the U.S. dollar overvalued. We expect the dollar to return to fair value in the coming decade, thanks to conditional mean reversion. Historical index attribution and the decomposition of our median dollar forecast into the drivers shown are based on an error correction model.

Source: Vanguard calculations, based on data from Refinitiv and the International Monetary Fund, as of September 30, 2023.

3. Policy rates differences. Changes in short-term (2-year) bond yields reflect expectations for central banks’ policy rates. We expect differences in cross-border short-term rates to continue to make a negligible positive contribution to the dollar as global inflation and policy rate differences converge in line with our economic outlook.

4. Inflation rate differences. Conventional wisdom suggests that higher inflation in one country should weaken its currency. When central banks have credible inflation-targeting frameworks, however, research finds that—all other factors being equal—upturns in inflation strengthen their currencies. That’s because accelerating price gains for goods and services also lead to higher expected interest rates. Cross-border inflation differentials boosted the dollar modestly in the last 10 years but likely will be a small force for depreciation going forward.

Even if the United States confounds our expectations by delivering meaningfully better productivity or higher long-term real rates than other countries in the coming decade, we think these factors will only modestly offset, rather than cancel out, the looming depreciation of the dollar. That said, overvaluation is not necessarily an indication that a dollar sell-off is imminent, especially if the global economy is headed for recession.

“We have high conviction that the U.S. dollar will correct over the long term to levels implied by fundamental economic forces,” said Kresnak. “But identifying the catalyst for a weakening dollar is difficult, and its volatility could lead to an abrupt correction or further deviations from fair value. For those reasons, we’d caution investors against trying to time to currency markets and instead encourage them to view our forecast as a modest long-term tailwind for globally diversified portfolios.”

* Our forecast of a 1.1% annualized decline reflects the median in the distribution of 10,000 Vanguard Capital Markets Model (VCMM) simulations for 10-year annualized changes in the U.S. dollar against an equity market-capitalization-weighted basket of the euro, the Japanese yen, the British pound, the Canadian dollar, and the Australian dollar. The dollar’s decline almost certainly will not prove linear.

** Vanguard believes investors should accept currency risk in their international equity allocations. Doing so lowers the correlation between international and domestic equity returns and hedges domestic inflation risk. Alternatively, we believe the currency risk in international fixed income allocations should be hedged. If unhedged, the volatility of such holdings can increase to equity-like levels, reducing the ability of bonds to provide ballast in portfolios.

*** To understand the influence of cross-border productivity differences on currency values, imagine a one-widget, two-economy world. If it costs $1.50 to produce a widget in the U.S. and the equivalent of $2 in the other country, theory says the exchange rate must be equivalent to $1.50/$2, or $0.75/foreign currency unit (FCU). If U.S. productivity grows, the U.S. could sell its widget for less—say, $1.10. Assuming no change in non-U.S. productivity, the exchange rate would fall to $1.10/$2 equivalent, or $0.55/FCU—that is, the dollar would appreciate.

Contributors

Ian Kresnak

Vanguard Investment Strategy Analyst

Lukas Brandl-Cheng

Vanguard Investment Strategy Analyst

Notes:

All investing is subject to risk, including the possible loss of the money you invest.

Investments in stocks and bonds issued by non-U.S. companies are subject to risks including country/regional risk and currency risk. These risks are especially high in emerging markets.

IMPORTANT: The projections and other information generated by the Vanguard Capital Markets Model® regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. VCMM results will vary with each use and over time.

The VCMM projections are based on a statistical analysis of historical data. Future returns may behave differently from the historical patterns captured in the VCMM. More important, the VCMM may be underestimating extreme negative scenarios unobserved in the historical period on which the model estimation is based.

The Vanguard Capital Markets Model® is a proprietary financial simulation tool developed and maintained by Vanguard’s primary investment research and advice teams. The model forecasts distributions of future returns for a wide array of broad asset classes. Those asset classes include U.S. and international equity markets, several maturities of the U.S. Treasury and corporate fixed income markets, international fixed income markets, U.S. money markets, commodities, and certain alternative investment strategies. The theoretical and empirical foundation for the Vanguard Capital Markets Model is that the returns of various asset classes reflect the compensation investors require for bearing different types of systematic risk (beta). At the core of the model are estimates of the dynamic statistical relationship between risk factors and asset returns, obtained from statistical analysis based on available monthly financial and economic data from as early as 1960. Using a system of estimated equations, the model then applies a Monte Carlo simulation method to project the estimated interrelationships among risk factors and asset classes as well as uncertainty and randomness over time. The model generates a large set of simulated outcomes for each asset class over several time horizons. Forecasts are obtained by computing measures of central tendency in these simulations. Results produced by the tool will vary with each use and over time.

A closer look

Our outlook for 2024

A return to sound money, with interest rates above inflation, is a real positive.

Americas

U.S. resilience may finally give way to the effects of restrictive monetary policy.

Asia-Pacific

China likely to stimulate its economy while Australia’s policy remains tight.

U.S. economy Q&A

Three Vanguard senior economists discuss interest rates, inflation, the labor market, and the broader U.S. economy.