Expert insight

Equities, fixed income, risk and return

February 11, 2025

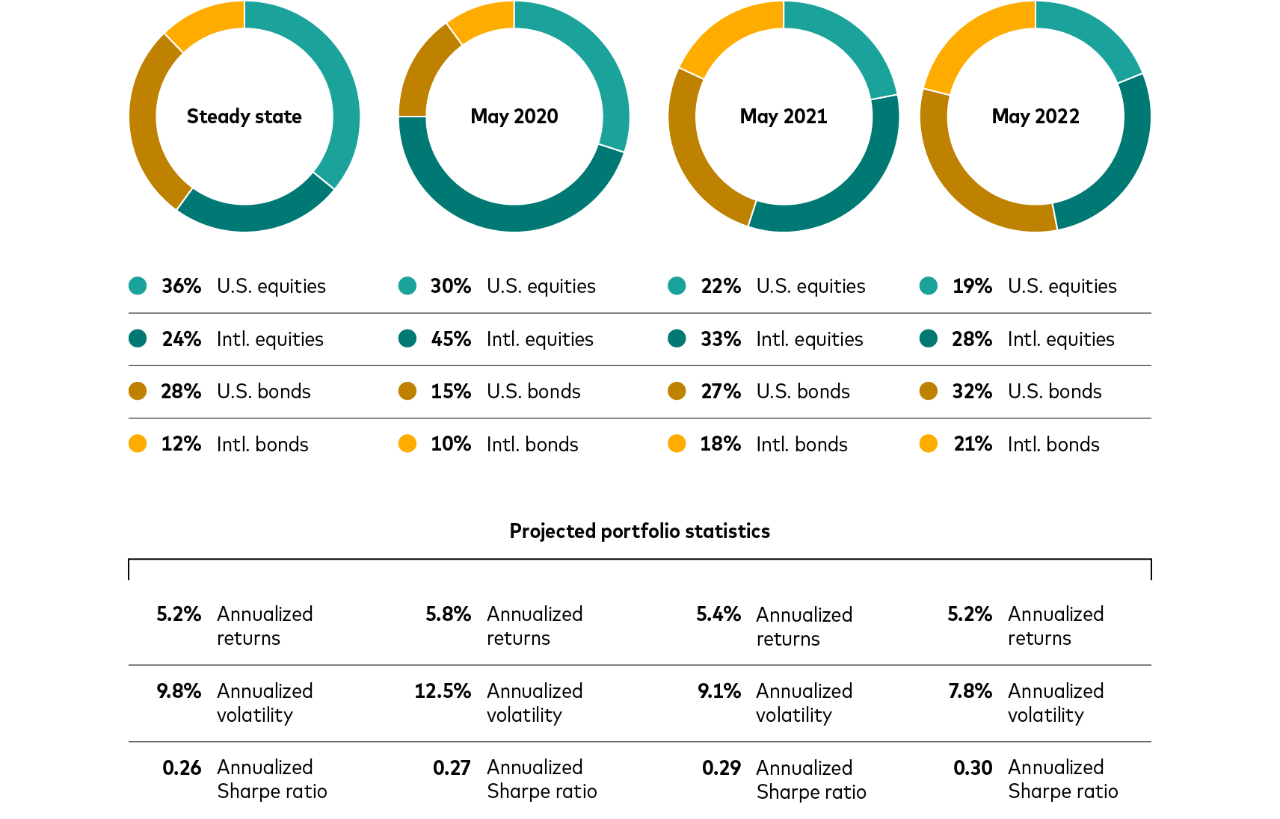

In this short video, Joel Dickson, Vanguard’s global head of advice methodology, discusses how you could take on less risk for the same expected return in this environment through a more conservative allocation of more bonds, less equities.

This video is one in a series of excerpts from a January 2025 webcast discussing our investment outlook. For more insights, visit our econ and market hub.

Read the transcript

Joel Dickson: If you're looking at this from a risk standpoint over the course of the next decade, the expectations between fixed income and especially U.S. equity returns suggest there's a lot of risk that could be mitigated without a give-up of expected return by having a bit more fixed income than maybe what you are.

Another way of saying that is that 60/40 portfolio a year ago, or two years ago, or three years ago, has a higher kind of risk profile to it than it does today in an environment where fixed income returns may be higher and fixed income returns are more stable than this. I do want to provide some context, though. That 40/60 portfolio, as talked about, has a similar expected return to a 60/40, right? It has, though, an expectation of about 30% lower volatility.

Notes: All investing is subject to risk, including the possible loss of the money you invest. Be aware that fluctuations in the financial markets and other factors may cause declines in the value of your account. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income.

Diversification does not ensure a profit or protect against a loss.

Investments in bonds are subject to interest rate, credit, and inflation risk.