Economics and markets

Resetting to a modestly higher neutral rate

June 23, 2022

The era of ultra-low neutral interest rates around the world may be coming to an end. Those rates have fallen by about 4 percentage points across developed economies over the last 40 years, boosting asset returns. Some of the drivers behind the decline, however, are lessening or even reversing. The transition to modestly higher neutral rates is setting the stage for some pain for the markets in the short term but better prospects further out, according to recently published research by Vanguard economists.

How we got here: Key drivers behind the fall in neutral rates

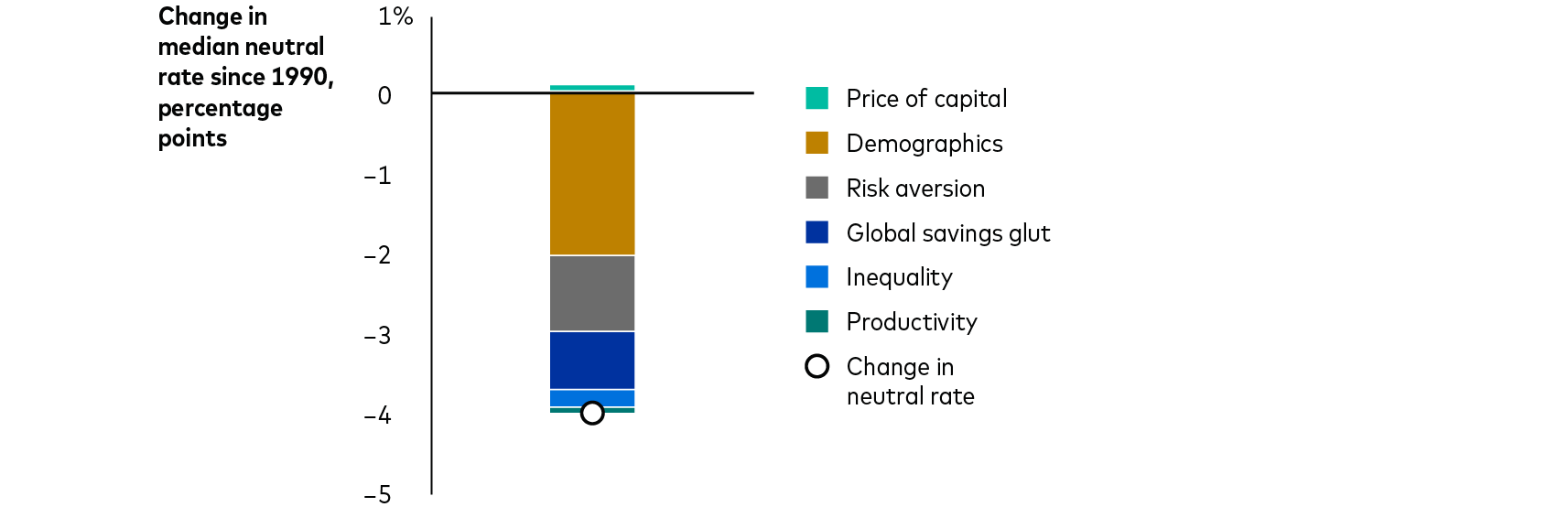

“Our research shows that neutral rates—which are the estimated levels of real interest rates that would support both full employment and stable inflation—have been driven lower by similar forces across all 24 developed-market economies,” said Roxane Spitznagel, a London-based Vanguard economist. The standout driver has been demographics, which has accounted for roughly half the decline in neutral rates, largely because of the drop-off in the number of new workers entering the workforce.

Investors’ reluctance to take on risk and the global savings glut have also contributed to the decline in neutral rates. Income inequality played a modest role as well.

Demographics have been the key driver pushing developed-market neutral rates lower in recent decades

Notes: We estimate the median neutral rate for 24 developed-market economies. These include Australia, Canada, Germany, Japan, Switzerland, the U.K., and the U.S. We include seven variables in our data set, all on a yearly basis. These are the short-term real interest rate and the six variables that drive developments in the neutral rate in our analysis. We include four-year moving averages of the driver variables to smooth out cyclical fluctuations.

Source: Vanguard, as of April 2022.

The road ahead: Lower for not much longer

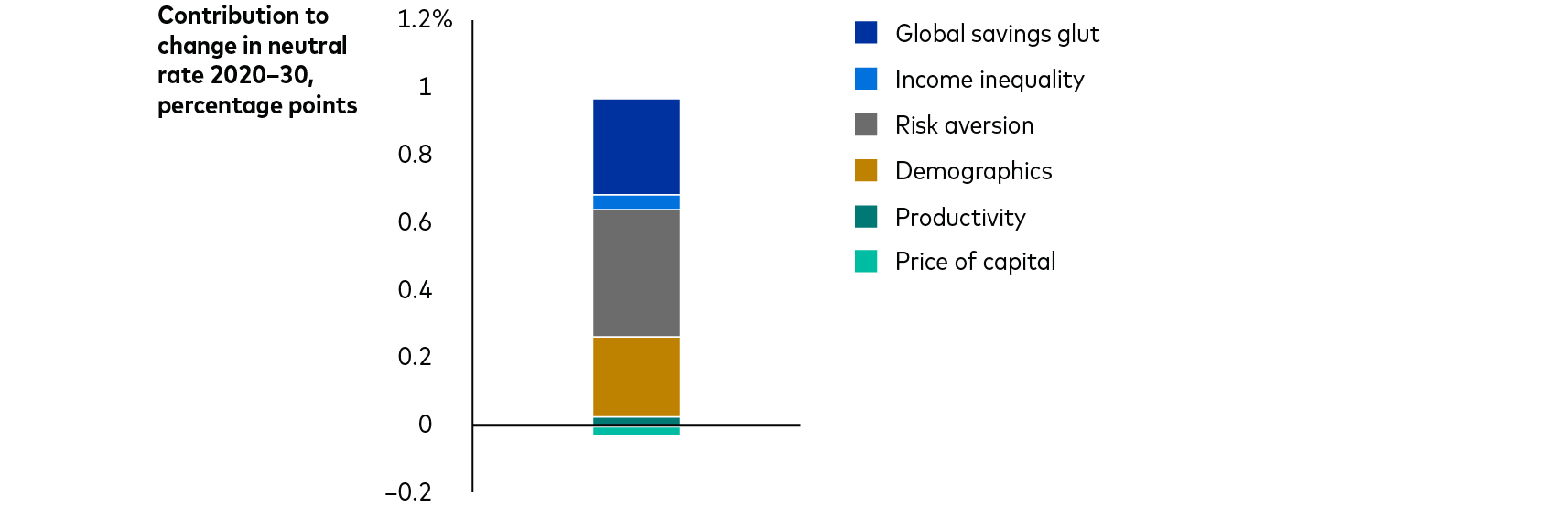

“Our forecast is for an overall rise in global neutral rates of around 1.1 percentage points over the next decade,” said Alexis Gray, a Melbourne-based Vanguard senior economist, “with all developed-market economies tracing an upward trajectory.”

Demographic dynamics are set to pivot and will soon help lift neutral rates. More new entrants to the workforce will add about 0.2 percentage points to the expected rise for the overall median developed-market neutral rate.

Three other primary contributors—some shrinkage in the global savings glut, decreased investor risk aversion, and cross-country convergence in income inequality—will be key, adding another 0.85 percentage points to our estimate.

Previous trends abating or reversing will contribute to a rise in neutral rates in developed markets

Notes: We forecast the median neutral rate for 24 developed-market economies. These include Australia, Canada, Germany, Japan, Switzerland, the U.K., and the U.S.

Sources: Vanguard model estimates are based on data from Penn World Tables, the Organisation for Economic Co-operation and Development, Our World in Data, the International Monetary Fund, the World Inequality Database, and the St. Louis Federal Reserve Database, as of April 2022.

Although it’s not a direct component of our econometric model, green investment to reach carbon neutrality would most likely boost neutral rates as well.

(It should be noted that our neutral rate forecasts depend on developments to underlying variables, some of which, like demographics, we can be quite certain of, while others, like risk aversion and inequality, we accept more humility in forecasting.)

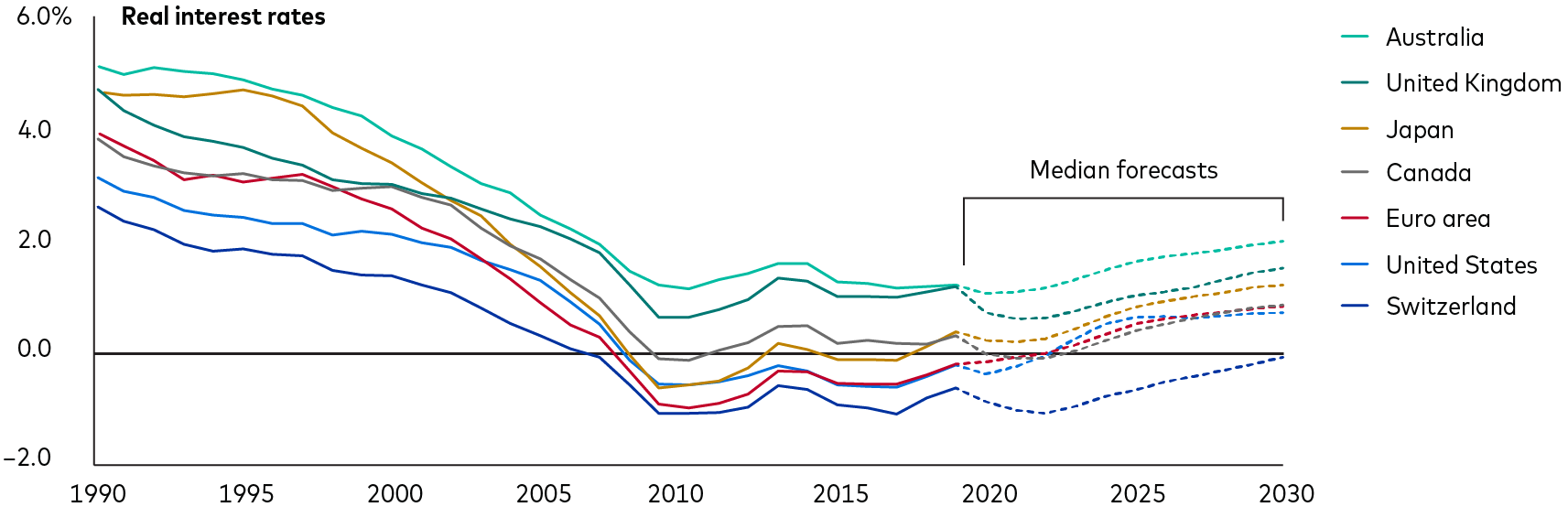

By region, the starting points and the magnitude of the increases will vary, but we expect to see this general pattern across developed-market economies.

Neutral rates are expected to rise modestly across developed markets this decade

Sources: Vanguard model estimates from 1990 through 2020 and forecasts from 2020 through 2030 are based on data from Penn World Tables, the Organisation for Economic Co-operation and Development, Our World in Data, the International Monetary Fund, the World Inequality Database, and the St. Louis Federal Reserve Database, as of April 2022.

What it could mean for investors

The secular decline in rates in recent decades has been a key determinant of global fiscal and monetary policy and a tailwind for economic growth and asset returns.

“For investors, the initial transition period to higher neutral rates may bring with it some short-term headwinds for equity and bond prices―higher interest rates result in negative price increases for bonds and, all else equal, reduce equity valuations,” said Adam Schickling, a U.S.-based Vanguard economist. “Over the coming decade, though, once neutral rates reach their new, higher equilibrium, the prospect of higher rates should translate into higher forward-looking asset returns via a higher risk-free rate that bond yields and equity returns are built upon.”

Notes:

All investing is subject to risk, including the possible loss of the money you invest.

Investments in bonds are subject to interest rate, credit, and inflation risk.

Contributors

Roxane Spitznagel

Alexis Gray

Adam Schickling