Higher inflation not the end of the 60/40 portfolio

June 26, 2023

In a 2021 paper, Vanguard researchers found that higher inflation can lead to a higher return correlation between stocks and bonds, offsetting some of a balanced portfolio’s diversification benefits. The worst-case scenario came to pass in 2022 to devastating effect for the traditional 60% stock/40% bond portfolio. However, it’s premature to call the 60/40 dead, even in a higher-inflation world. Two of our experts discuss expectations for U.S. inflation and returns, inflation-hedging assets, and the viability of the 60/40 portfolio.

“There’s legitimate concern that higher inflation and higher correlations are here to stay even if they do moderate from recent high levels,” said Kevin DiCiurcio, head of Vanguard Capital Markets Model development. “We think that permanently elevated inflation is not likely; our recent experience is more of an aberration than a new reality. But our research indicates that even if inflation stays elevated, the portfolio outcomes for long-term investors won’t be drastically different.”

Why inflation should moderate

“We believe that, when it comes to inflation, the next decade will look more like the past two decades rather than the 1970s or 1980s,” said Ian Kresnak, a Vanguard investment strategy analyst. “Structural factors have pushed inflation higher, but we expect central banks to continue to combat higher prices with higher rates, bringing inflation back to target and keeping it there.

“Higher rates mean higher long-term expected returns, which is good for investors,” Kresnak said. “And they provide room for central banks to ease rates in a crisis.”

Still, our experts can see the argument for the inclusion of more explicit inflation-hedging assets—commodities, TIPS, and foreign equities not hedged to the U.S. dollar—in a high-inflation environment, as long as they’re otherwise appropriate for the investor’s goals and risk tolerance.

“But some of the more exotic asset classes can carry higher expenses that offset any perceived diversification benefits,” Kresnak added.

What happens if inflation remains elevated

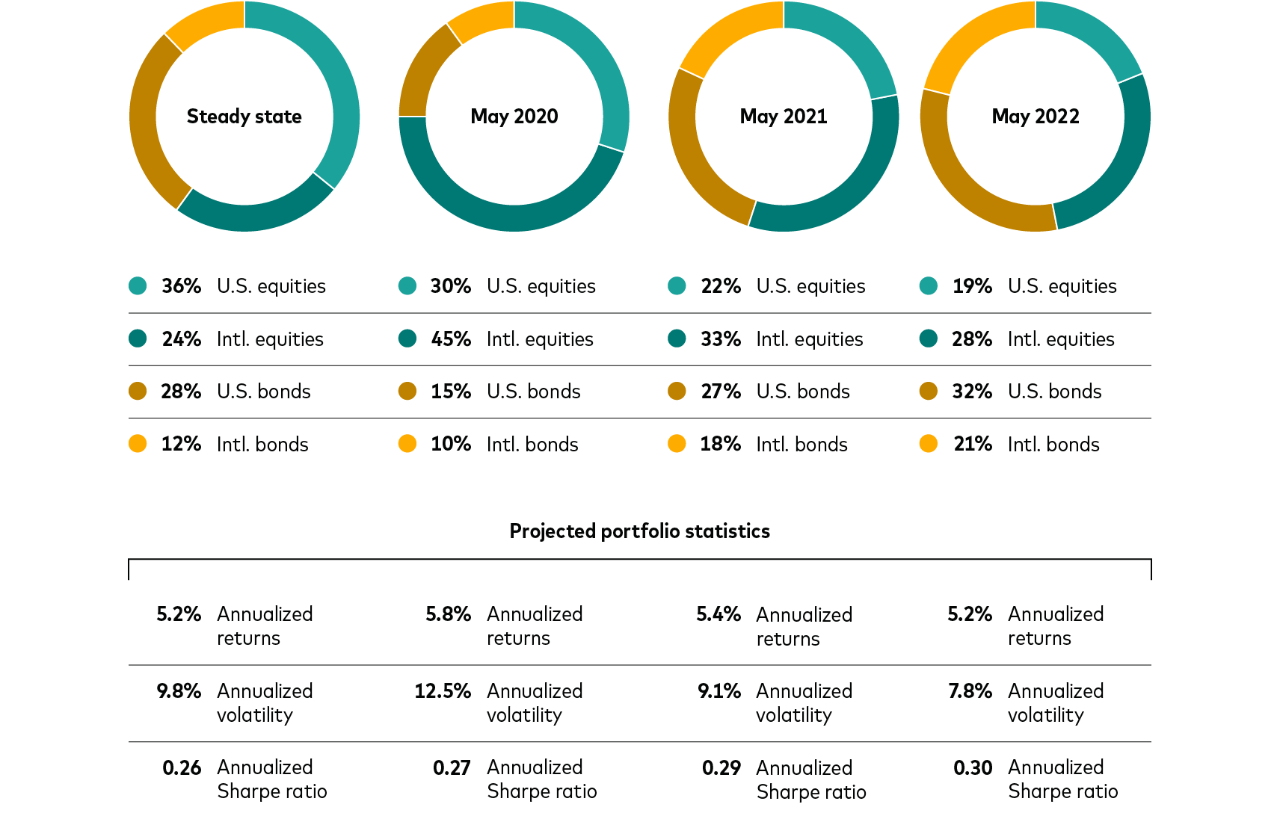

Vanguard ran simulations for two portfolios in two different environments. One portfolio consisted of 60% global stocks and 40% global bonds. The other had an allocation to commodities (10%) in the equity portion and to intermediate-term TIPS (8%) in the bond portion.

One of the two environments represented our baseline, using Vanguard’s current projections for broad asset class returns, inflation, and return correlations over the next 10 years. The other envisioned a future with higher inflation and higher correlations (in many cases, a positive correlation instead of a negative one).

Low or negative correlation means the prices for two asset classes are less likely to move in tandem, even moving in the opposite direction, lowering risk for the overall portfolio. Higher correlations mean prices are likely to move more in tandem, increasing volatility or risk for the portfolio. Higher inflation tends to increase correlation by dampening nominal bond prices and reducing expectations for equities’ real earnings growth.

“Portfolios in the higher inflation, higher correlation scenario had higher volatility and worse potential declines than the baseline scenario,” DiCiurcio said. “That was true for both the traditional global 60/40 portfolio and the one that included commodities and TIPS. The latter portfolio did have somewhat less volatility than the traditional 60/40, alleviating downside risk in particular.

“But what’s remarkable was how similar the range of potential outcomes over 10 years were across both portfolios and both scenarios. It reinforces our earlier findings that asset allocation—not inflation or correlation—is the main determinant of long-term returns.”

Notes: The traditional 60/40 portfolio is a mix of 36% U.S. equities, 24% non-U.S. equities, 28% U.S. investment-grade taxable bonds, and 12% non-U.S. bonds. The inflation-hedged portfolio is a mix of 30% U.S. equities, 20% non-U.S. equities, 10% commodities, 22% U.S. investment-grade taxable bonds, 8% U.S. TIPS, and 10% non-U.S. bonds. The following indexes were used as proxies for each asset class: MSCI US Broad Market Index for U.S. equities, MSCI All-Country ex USA Index for non-U.S. equities, Bloomberg US Aggregate Bond Index for U.S. bonds, Bloomberg Global Aggregate ex-USD Index for non-U.S. bonds, Bloomberg US Treasury Inflation-Protected Securities Index for TIPS, and Bloomberg Commodity Index for commodities.

Source: Vanguard, as of May 31, 2023.

IMPORTANT: The projections and other information generated by the VCMM regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. Distribution of return outcomes from VCMM are derived from 10,000 simulations for each modeled asset class. Simulations are as of May 31, 2023. Results from the model may vary with each use and over time. For more information, please see the Notes section below.

It's the destination, not the journey

“It turns Emerson’s quote on its head,” DiCiurcio said. “When it comes to investing, it’s the destination—the final outcome—that’s more important than the journey itself, which may be quite volatile.”

"There are many ways to measure risk in our industry,” Kresnak said. “But these metrics all tend to focus more on the bumps in the road and not the final destination. We prefer to measure risk or success by the wealth outcomes at the end of an investor’s time horizon. Ultimately, investors are saving for a goal, and they care more about that than the potholes along the way.”

Our researchers say investors would need to make four assumptions to conclude that the 60/40 portfolio was no longer viable:

- A decade or more of rising inflation is ahead.

- Policymakers are unable to bring about price stability.

- The only diversification benefit comes from low return correlations.

- More complex investments will benefit from rising inflation and provide high enough returns to exceed their typically higher expenses.

"Barring that scenario, the 60/40 is still that reliable family minivan that will help get you to your destination,” DiCiurcio said. “It’s not time to trade it in yet.”

Lukas Brandl-Cheng and the Vanguard Capital Markets Model team contributed to the research for this article.

Contributors

Ian Kresnak

Vanguard Investment Strategy Analyst

Notes:

All investing is subject to risk, including the possible loss of the money you invest. Be aware that fluctuations in the financial markets and other factors may cause declines in the value of your account. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income.

Past performance does not guarantee future results.

In a diversified portfolio, gains from some investments may help offest losses from others. However, diversification does not ensure a profit or protect against a loss.

Bond funds are subject to the risk that an issuer will fail to make payments on time, and that bond prices will decline because of rising interest rates or negative perceptions of an issuer's ability to make payments. Investments in bonds are subject to interest rate, credit, and inflation risk.

IMPORTANT: The projections and other information generated by the Vanguard Capital Markets Model regarding the likelihood of various investment outcomes are hypothetical in nature, do not reflect actual investment results, and are not guarantees of future results. VCMM results will vary with each use and over time.

The VCMM projections are based on a statistical analysis of historical data. Future returns may behave differently from the historical patterns captured in the VCMM. More important, the VCMM may be underestimating extreme negative scenarios unobserved in the historical period on which the model estimation is based.

The Vanguard Capital Markets Model® is a proprietary financial simulation tool developed and maintained by Vanguard’s primary investment research and advice teams. The model forecasts distributions of future returns for a wide array of broad asset classes. Those asset classes include U.S. and international equity markets, several maturities of the U.S. Treasury and corporate fixed income markets, international fixed income markets, U.S. money markets, commodities, and certain alternative investment strategies. The theoretical and empirical foundation for the Vanguard Capital Markets Model is that the returns of various asset classes reflect the compensation investors require for bearing different types of systematic risk (beta). At the core of the model are estimates of the dynamic statistical relationship between risk factors and asset returns, obtained from statistical analysis based on available monthly financial and economic data from as early as 1960. Using a system of estimated equations, the model then applies a Monte Carlo simulation method to project the estimated interrelationships among risk factors and asset classes as well as uncertainty and randomness over time. The model generates a large set of simulated outcomes for each asset class over several time horizons. Forecasts are obtained by computing measures of central tendency in these simulations. Results produced by the tool will vary with each use and over time.

A closer look

Asia-Pacific

China's and Australia's economies share one attribute: Growth slowdowns are likely.

10-year asset-class returns

Our 10-year annualized return forecasts are modestly lower since the start of the year for most developed markets.