China, Australia

Our economic and market outlook at midyear 2022

July 13, 2022

We expect the economies in China and Australia to grow more slowly than we forecast at the start of the year. Further COVID-19 outbreaks remain a risk in China, given its zero-COVID policy, while global factors guide our view on Australia.

“Global growth and inflation are important factors for Asia-Pacific economies, though domestic factors primarily drive our outlook for China.”

– Qian Wang, Vanguard Asia-Pacific chief economist.

China

~3%

Economic growth

We foresee China’s 2022 growth falling short of our 5% forecast at the start of the year as three priorities clash. A commitment to financial stability and a zero-COVID policy leave policymakers’ target for growth “around 5.5%” vulnerable amid a weak domestic labor market and slowing global growth.

<2.5%

Headline inflation

Inflation has increased toward midyear but remains unlikely to reach policymakers’ 3% target. Spillover from building global inflation pressures is likely to be offset by the weakening domestic growth picture. Producer price inflation remains elevated but in recent years has had little pass-through to consumer prices.

2.75%

Monetary policy

We expect only one further 10-basis-point cut in the one-year medium-term lending facility rate, in line with consensus. We expect intensified policy efforts this year to focus on fiscal policy. Monetary policy is constrained by external and domestic forces: global central banks’ tightening paths and a desire not to overstimulate China’s property sector.

~5.5%

Unemployment rate

Our year-end forecast for the unemployment rate is higher than consensus and 100 basis points above the level that would be expected to promote inflation. China’s below-trend growth translates to slack in the labor market, with recent university graduates faring worst.

What to watch

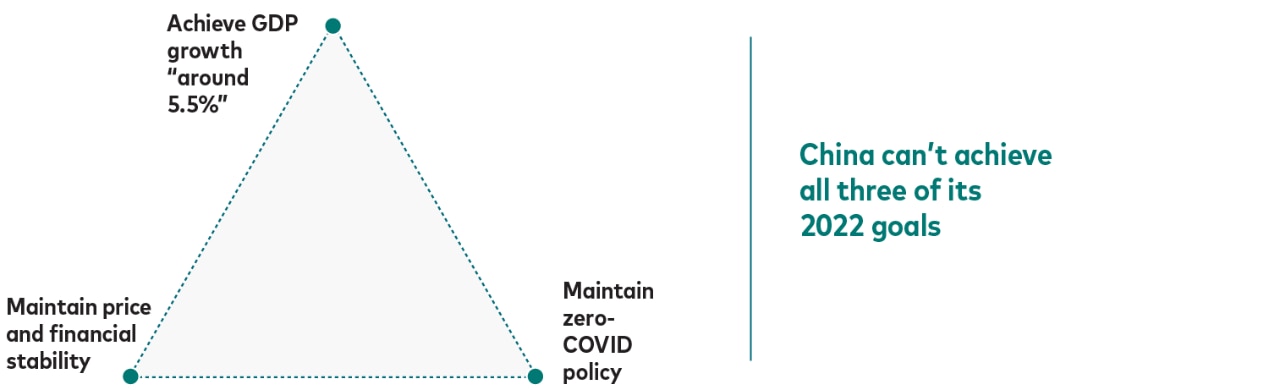

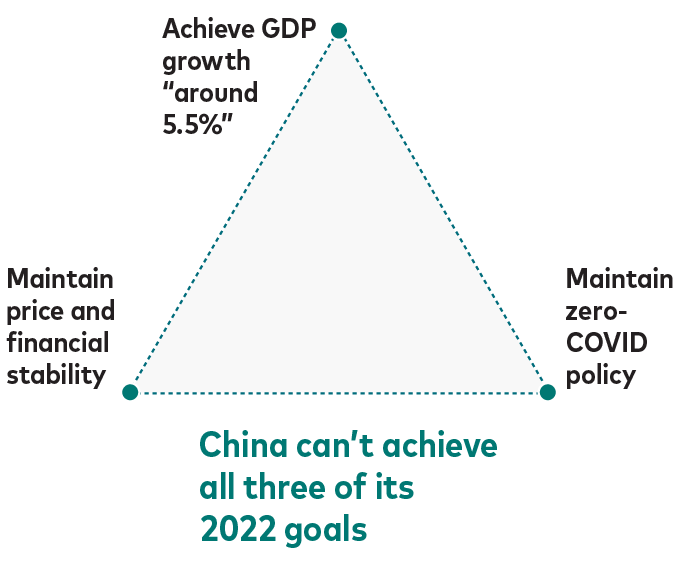

China’s “policy trilemma”

China isn’t in position to achieve all three of its 2022 goals. We believe that policymakers will remain committed to a zero-COVID policy and maintaining price and financial stability, leaving the growth target vulnerable.

Source: Vanguard.

Australia

3%–3.5%

Economic growth

Global factors including effects of the war in Ukraine and tightening financial conditions as inflation soars have pushed our 2022 growth forecast down by a percentage point since the start of the year. Its status as a commodities exporter may not be enough to save Australia from recession in 2023 if large developed markets take that path.

~7%

Headline inflation

Even as their impact may subside over the next 12 months, high energy prices will likely push up prices for an array of goods and services. A tight labor market and wage growth are likely to keep core inflation above 3% through 2023. Inflation is above the Reserve Bank of Australia’s target and hasn’t peaked yet.

~2.5%

Monetary policy

Broad-based and persistent inflation has the Reserve Bank of Australia on course to raise its rate target by more than two percentage points in 2022, from a starting point near zero. We expect the cash rate to eventually exceed a neutral rate that we estimate at 3%, though a slowing economy may mean a pause at some point.*

~4%

Unemployment rate

Unemployment at a historical low just below 4% will likely stabilize as growth momentum slows. Labor shortages will take time to resolve, however, and we anticipate upward pressure on wages to persist. Thwarting a wage-price spiral will be a goal as the Reserve Bank of Australia seeks to re-anchor inflation expectations.

What to watch

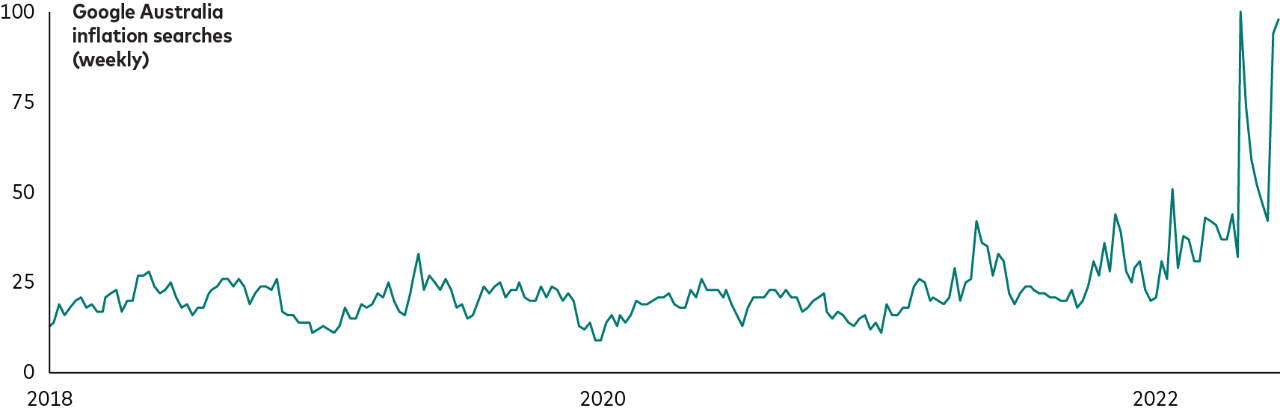

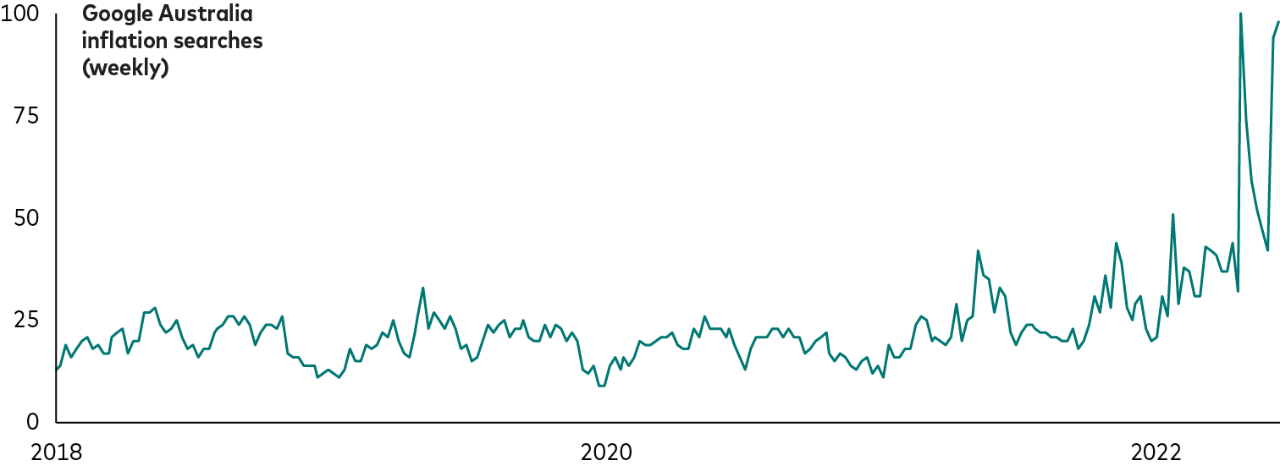

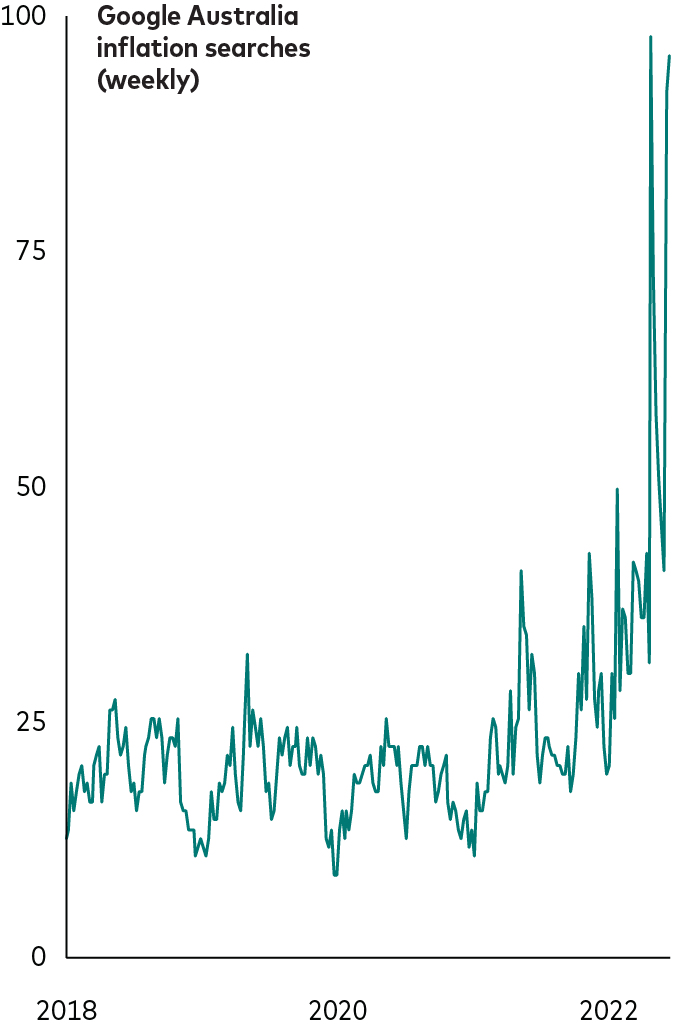

A new inflation psychology

Inflation is suddenly top of mind for Australians, to the point that they’re factoring it into their decisions and adapting their lives to it. Such an un-anchoring of inflation expectations can spiral out of control—and we expect the Reserve Bank of Australia to act decisively to prevent that.

Notes: A value of 100 represents peak popularity of a search term. A value of 50 means the term is half as popular.

Source: Google Trends, as of June 20, 2022.

The outlook for emerging Asia

We recently downgraded our forecast for full-year 2022 growth in global emerging markets, from about 5.5% at the start of the year to about 3%. Emerging markets continue to face headwinds from slowing growth in the United States, the euro area, and China, as well as from developed markets’ central bank tightening and from domestic and global inflation.

Prices have been on the rise recently in emerging Asia, where inflation wasn’t initially of the same concern as in Latin America and emerging Europe. Whereas several Latin America and emerging Europe markets are pricing in 2023 central bank interest rate cuts as economies are expected to slow, emerging Asia markets are still pricing in rate increases of 100 to 200 basis points or more for the year ahead but much less aggressive hikes beyond that.

Figures related to economic growth, inflation, monetary policy, and unemployment rate are Vanguard forecasts for the end of 2022. Growth and inflation are comparisons with year-end 2021; monetary policy and unemployment rate are absolute levels.

*The neutral rate is the theoretical interest rate at which monetary policy neither stimulates nor restricts an economy.

A closer look

Our midyear 2022 outlook

Recession isn’t a forgone conclusion, but curbing inflation without stifling growth will be hard.

Americas

A U.S. “soft landing” is looking less likely with the Federal Reserve’s higher policy rate landscape.

Europe

Our outlook for the euro area has been downgraded amid energy prices sent soaring by war.

10-year asset-class returns

Falling equity valuations and rising interest rates have largely increased our return forecasts.

Time-varying portfolios

Strategic asset allocation, not market timing, may benefit some investors given changing conditions.