Research summary

How financial advice can reduce stress and save time

July 09, 2025

The financial advice industry has traditionally focused on the money management benefits it offers to investors, such as portfolio construction and monitoring. However, this emphasis can overshadow the broader and often intangible benefits that investors derive from professional guidance. Beyond the numbers, paid financial advice offers emotional benefits and significant time savings, allowing investors to manage the complexities of their financial lives by turning to trusted experts.

In a recently published research paper, The Emotional and Time Value of Advice, Vanguard Investment Strategy Group’s Paulo Costa, Marsella Martino, and Malena de la Fuente delve into the emotional and time-saving benefits that investors can gain from professional financial advice. In general, advised clients report getting emotional value as well as spending less time thinking about and dealing with their finances.

How the study was conducted

To explore these results, the paper’s authors surveyed 12,443 Vanguard investors, of whom 62% were also advised by Vanguard. The survey provided valuable insights into how financial advice affects clients’ emotional well-being and productivity. Respondents answered questions about their emotions and perceptions regarding their finances, the time they spend managing their finances, and their overall perceptions of financial advice and their well-being.

“Rather than just look at existing data, we conducted a survey, because the perception of emotion is what really matters,” de la Fuente said. “It’s about really getting into investors’ minds.”

Advice increases peace of mind

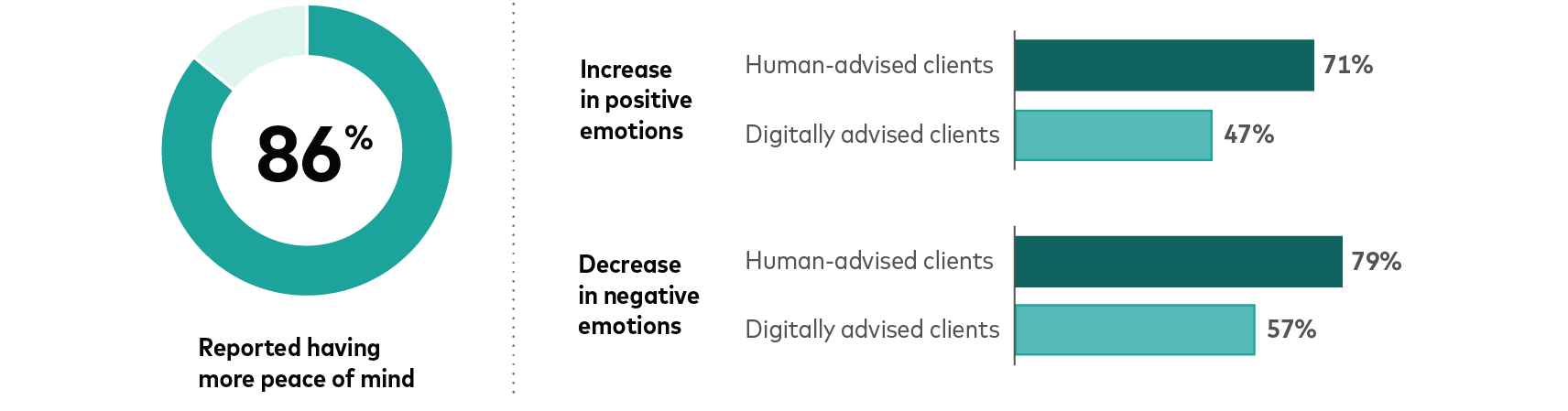

The survey results highlight a significant perceived emotional benefit for advised investors. According to the findings, advised investors are roughly half as likely to experience high levels of financial stress compared with self-directed clients (14% versus 27%). In addition, 86% of clients using either digital or human advisors report having more peace of mind. This figure rises to 88% for those with a human advisor, but even clients using digital advice benefited, with 69% reporting increased peace of mind.

Advised clients, whether they work with human advisors or are digitally advised, also report substantial improvement in their emotional state. Among human-advised clients, 71% said they experienced an increase in positive emotions such as confidence and security, and 79% experienced a decrease in negative emotions such as anxiety, worry, sadness, disappointment, and feelings of being overwhelmed. The figures were still substantial among digitally advised clients: 47% experienced an increase in positive emotions and 57% experienced a decrease in negative emotions.

“Human-advised clients are more likely to report improvements in their emotions, consistent with previous research,” Costa said. “What’s somewhat surprising is how digital advice does well in helping clients not feel anxious or ashamed when interacting with the service. For example, 85% of digitally advised clients report not feeling ashamed when using digital advice.”

Advice increases peace of mind and positive emotions while decreasing negative emotions

Note: The survey asked clients to indicate the applicable option in the statement, “Compared to managing my finances on my own, having an advisor/digital advisor service gives me (a lot less / less / neither more nor less / more / a lot more) peace of mind.”

Source: Vanguard.

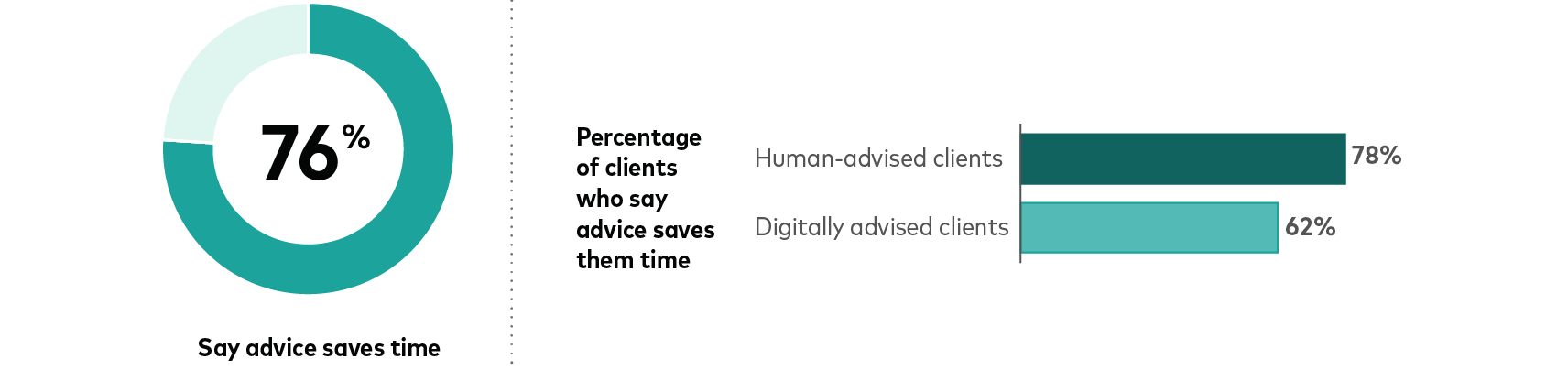

Advice can save time and boost productivity

The survey reveals that, on average, Vanguard investors spend 4.3 hours per week managing their finances. Advised investors spend significantly less time—3.8 hours per week—compared with self-directed investors, who spend 5.5 hours per week. About 76% of advised clients report that advice saves them time, with median time savings of approximately two hours per week, or over 100 hours per year. These time savings are even more pronounced for human-advised clients, with 78% reporting time savings, compared with 62% for digitally advised clients.

The time saved is not just a personal benefit; it also has implications for the workplace. Workers in employer plans report spending an average of 3.8 hours per week distracted at work by financial stress, leading to a yearly productivity loss for employers of $5,950 to $6,775 per employee. Advised clients, on the other hand, are less distracted. About 50% of financially stressed clients who get Vanguard advice reported a reduction in work distractions. On average, advice reduces distractions by almost two hours per week, translating into potential productivity savings of $2,200 to $5,850 per year. Given that workplace digital advice costs 0.15% per year (or an average of $642 per year for the clients surveyed), it presents a highly cost-effective outcome for employers.1

Advice can save investors time

Note: The survey asked client to indicate the applicable option in the statement, “Compared to managing my finances on my own, having a financial advisor/digital advisor (saves me time / does not save or cost me time / costs me time) thinking about and dealing with my finances.”

Source: Vanguard.

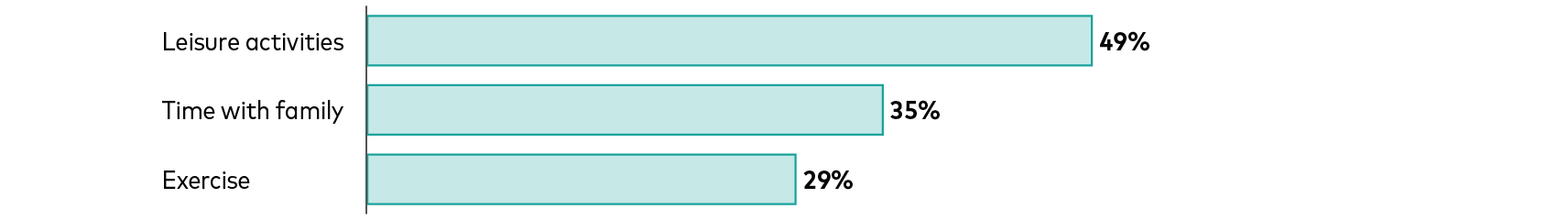

What investors do with their extra free time

The survey also explored how investors use the time they save by receiving financial advice. Almost half (49%) of the respondents said they used the extra time for leisure activities, while 35% spent more time with their families. In addition, 29% used the time for exercise, and 27% used it for household chores. These activities contribute to clients’ overall well-being, beyond just financial health. By working with an advisor, clients can focus on other important aspects of their lives, enhancing their quality of life.

Advised clients spend their saved hours in various ways

Note: The survey asked, “What activities have you done more of with the time financial advice has saved you? Select all that apply.”

Source: Vanguard.

Underestimating the value of advice

When asked about their initial reasons for signing up for financial advice, 87% of respondents considered portfolio value, 74% considered emotional value, 69% considered financial value, and 38% considered time value. However, 86% of clients reported experiencing emotional benefits after being enrolled, and 76% reported time savings. This shows that the perceived emotional and time-saving aspects of advice are often underappreciated initially by investors.

Implications for investors, advisors, and plan sponsors

This research demonstrates that financial advice offers significant value beyond traditional portfolio construction and financial planning. For investors and their financial advisors, it suggests that the emotional and time-saving benefits of advice are not fully recognized at the outset. Advisors can help educate investors up front about these additional attributes to offer a more complete perspective on the value of advice.

For plan sponsors, the findings emphasize the impact of the emotional and time benefits on employees’ overall well-being and productivity. By recognizing and promoting these advantages, plan sponsors can better support their employees by offering advice in their plans.

“Understanding how financial advice saves clients’ time is important, both for advisors who’d like to know how they’re being most helpful and for plan sponsors who could benefit from fewer financial distractions in the workplace and higher worker productivity,” Martino said. “The peace of mind and time savings that clients experience should be integral metrics when evaluating the value of financial advice.”

1 We calculate the cost of advice in dollar terms as the average of each worker’s retirement account balance multiplied by 0.15%--the cost of digital workplace advice.

Notes:

All investing is subject to risk, including the possible loss of the money you invest.

Advice services are provided by Vanguard Advisers, Inc., a registered investment advisor, or by Vanguard National Trust Company, a federally chartered, limited-purpose trust company.

Contributors